Reference letter: UBS Investment Bank, Zurich

I've worked on a number of foreign exchange trading and treasury projects for different banks.

At the time of the credit crisis from 2007-2008, financial regulators were keen for banks to increase scrutiny of the trades executed by their traders.

Prior to this, traders could make several trades throughout the course of the day and the bank would only become aware of the trades some hours later or in the evening. New regulations required banks to signal the trades to their counterparties within minutes rather than hours.

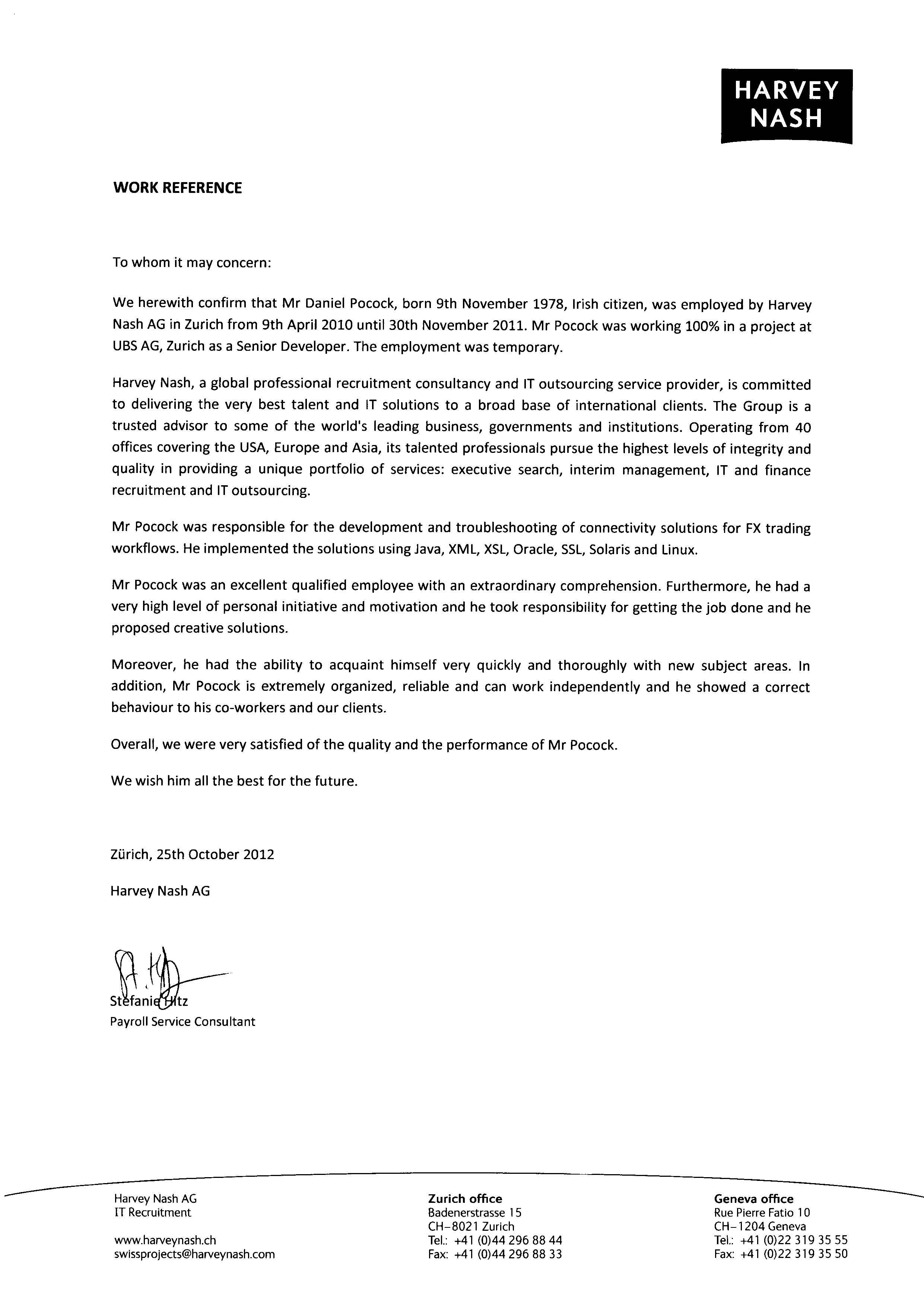

UBS contracted me to implement these messaging systems for a range of FX and FX derivative trades. The letter below explains more about how I assisted them to improve their systems at this important time.