Jeffrey Epstein crypto disclosure: uncanny timing, Bitcoin demise, pump-and-dump, ponzi schemes

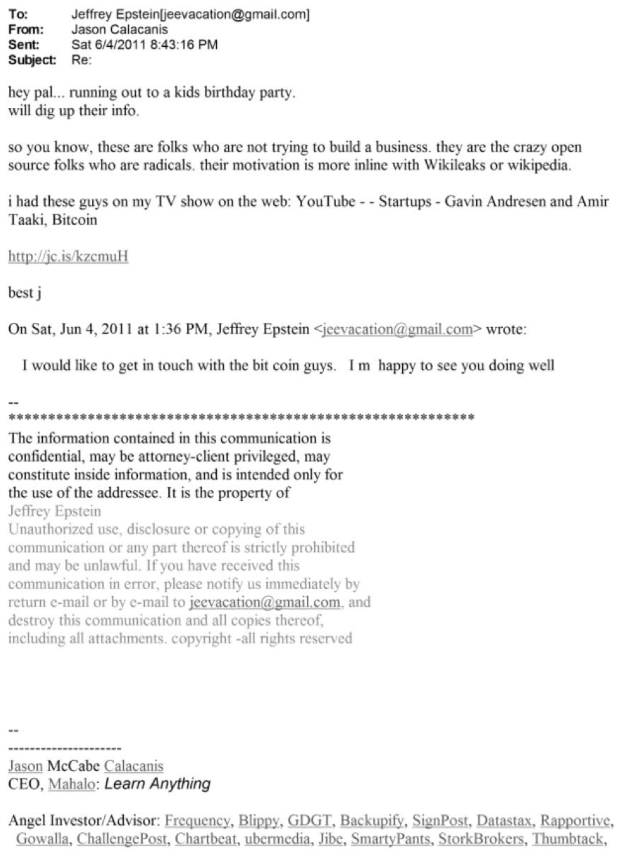

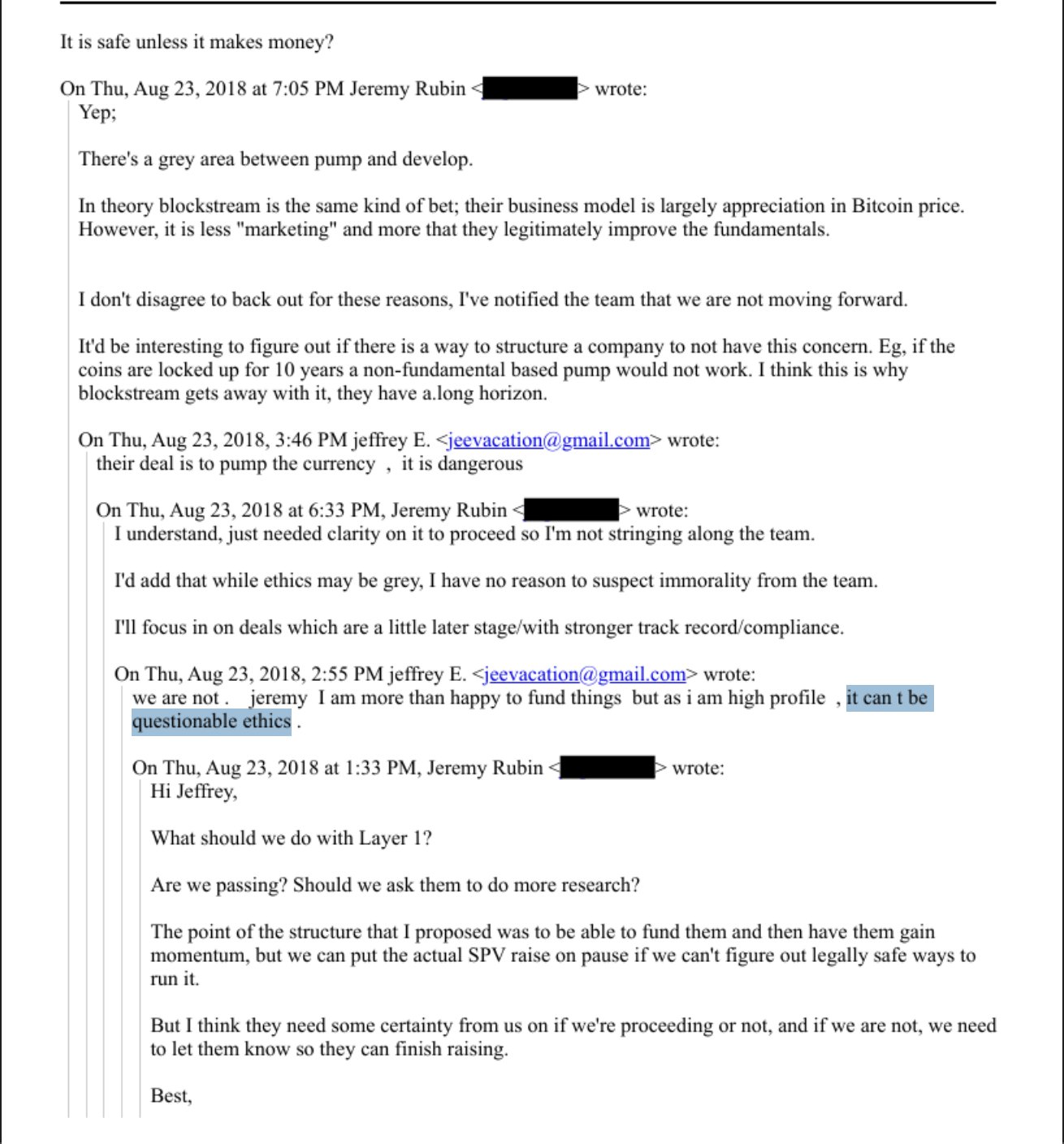

US Justice Department officials have recently released another three million Jeffrey Epstein documents. One of those was an email discussion about a cryptocurrency investment. Epstein immediately suspected it was a pump-and-dump scheme and he felt that his involvement would be a bad idea due to "questionable ethics".

The fact this email was exposed now is another unlucky coincidence for Bitcoin. The original cryptocurrency has been on the ropes after suddenly losing half of its value. News reports talk of a death spiral. Anybody who is about to try cryptocurrency for the first time is going to take one look at the very steep fall on the charts and they are going to try something else instead, like the rush for a traditional safe haven: gold and silver bullion.

Bitcoins in circulation are allegedly worth $2.2 trillion. That figure is only valid in the hypothetical scenario where every Bitcoin could be simultaneously converted to US dollars. In practice, markets don't work that way.

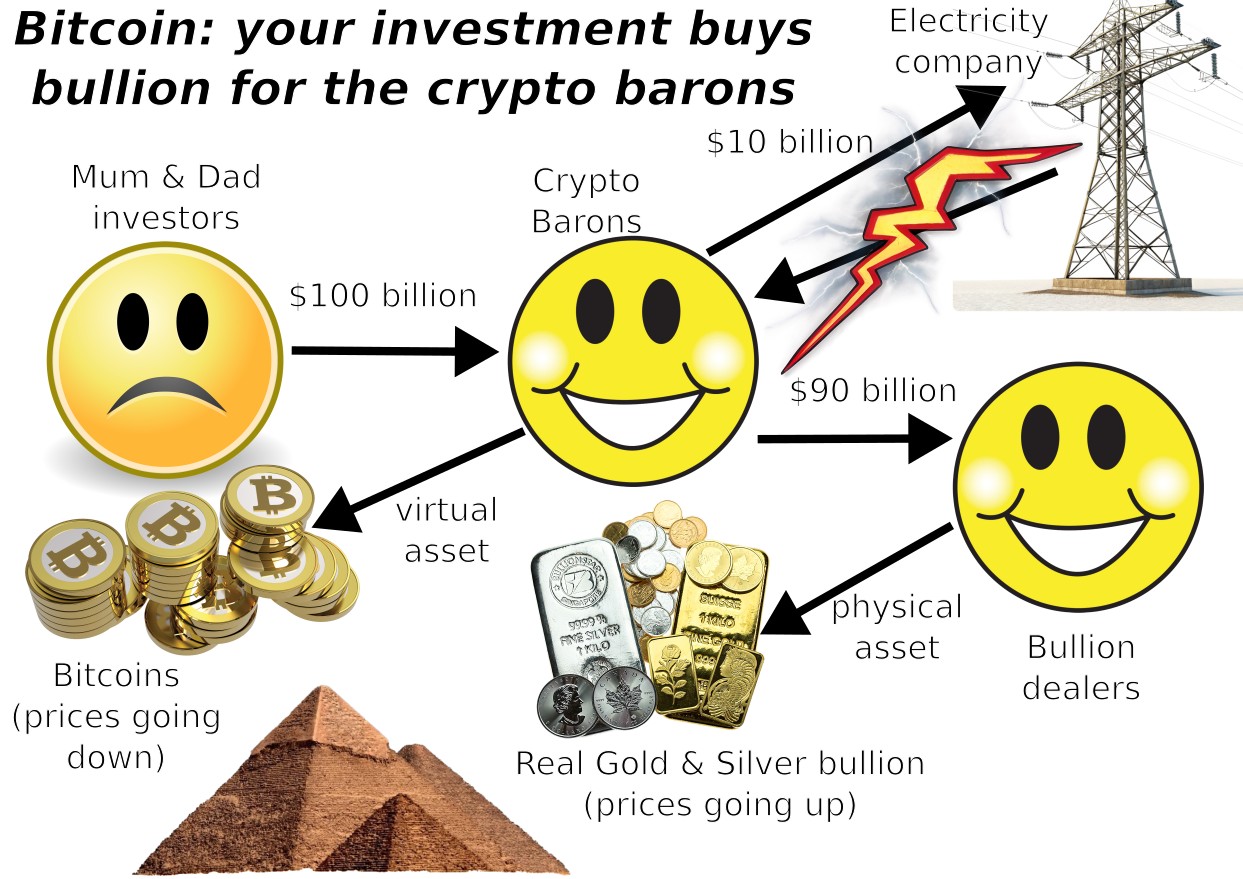

We can roughly estimate the amount of electrical energy used to produce the Bitcoins in circulation. From there, we would anticipate that Bitcoin miners have sold enough Bitcoins to pay their bills and keep mining more.

In practice, it looks like some of the smartest investors were selling their Bitcoins while the price was over $100,000 and they used that money to buy gold and silver bullion before the prices of those metals started to gain momentum.

Where did that money come from though? New investors who decided to try cryptocurrency for the first time. Those are the people holding on to their Bitcoins right now hoping the price will go back up again.

Continue reading the inconvenient truth about cryptocurrency.

The author holds an MIT MicroMasters in Data, Economics and Development Policy. He does not hold any crypto "assets". Swiss financial regulator FINMA will neither confirm nor deny an investigation on this blog precipitated the resignation of their deputy CEO .