Expensive errors: Forbes Gold price, $44 billion Bitcoin given away by Bithumb, South Korea

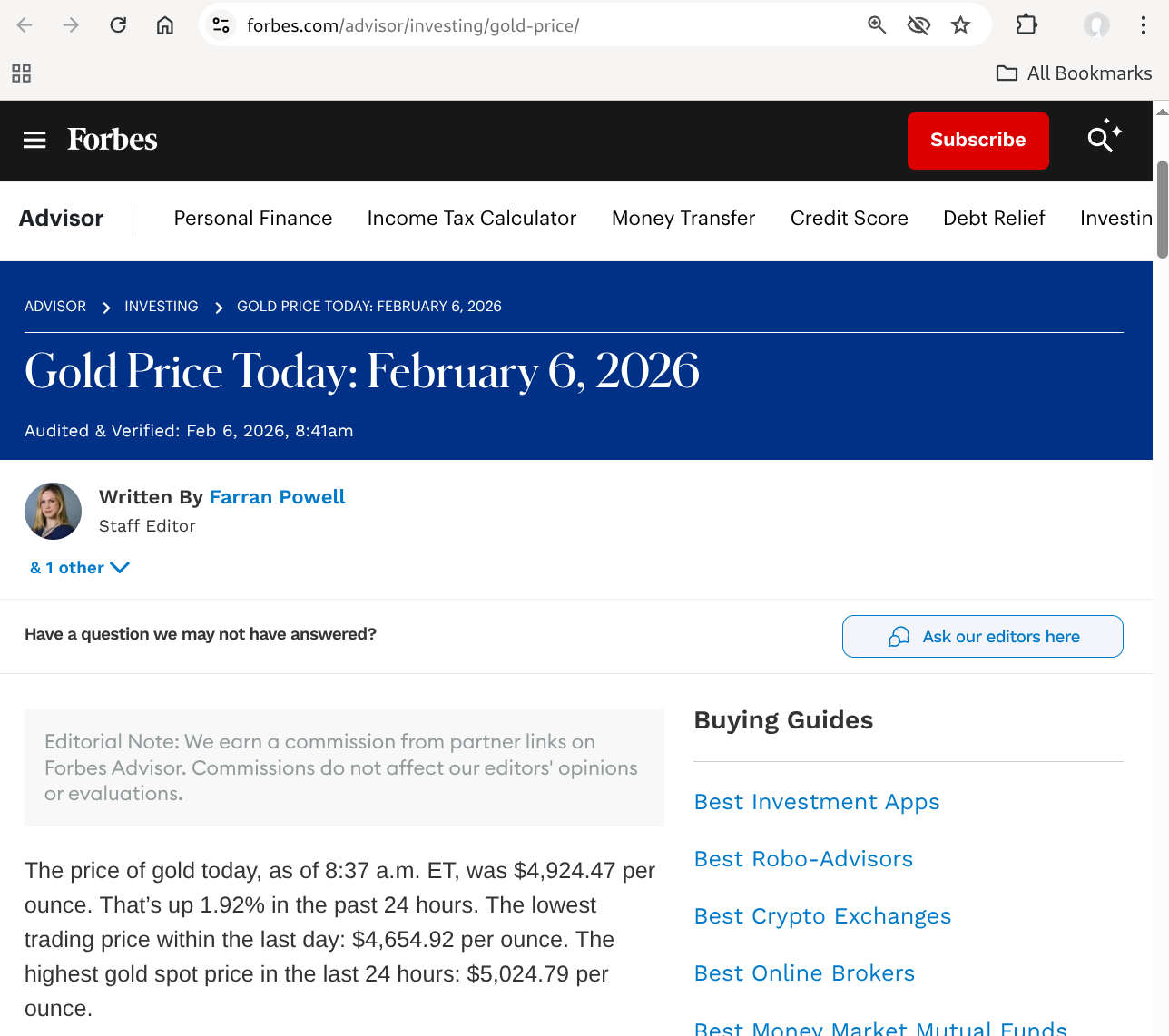

While preparing my previous blog about the appearance that Forbes no longer shows Bitcoin prices in regions where regulators expressed concerns, I wanted to check the accuracy of the phenomena I was observing. I did a comparable search for "Forbes gold prices" to see if those pages would give me the same error. I was able to access the last report about gold but in this case, I found the data itself was wrong.

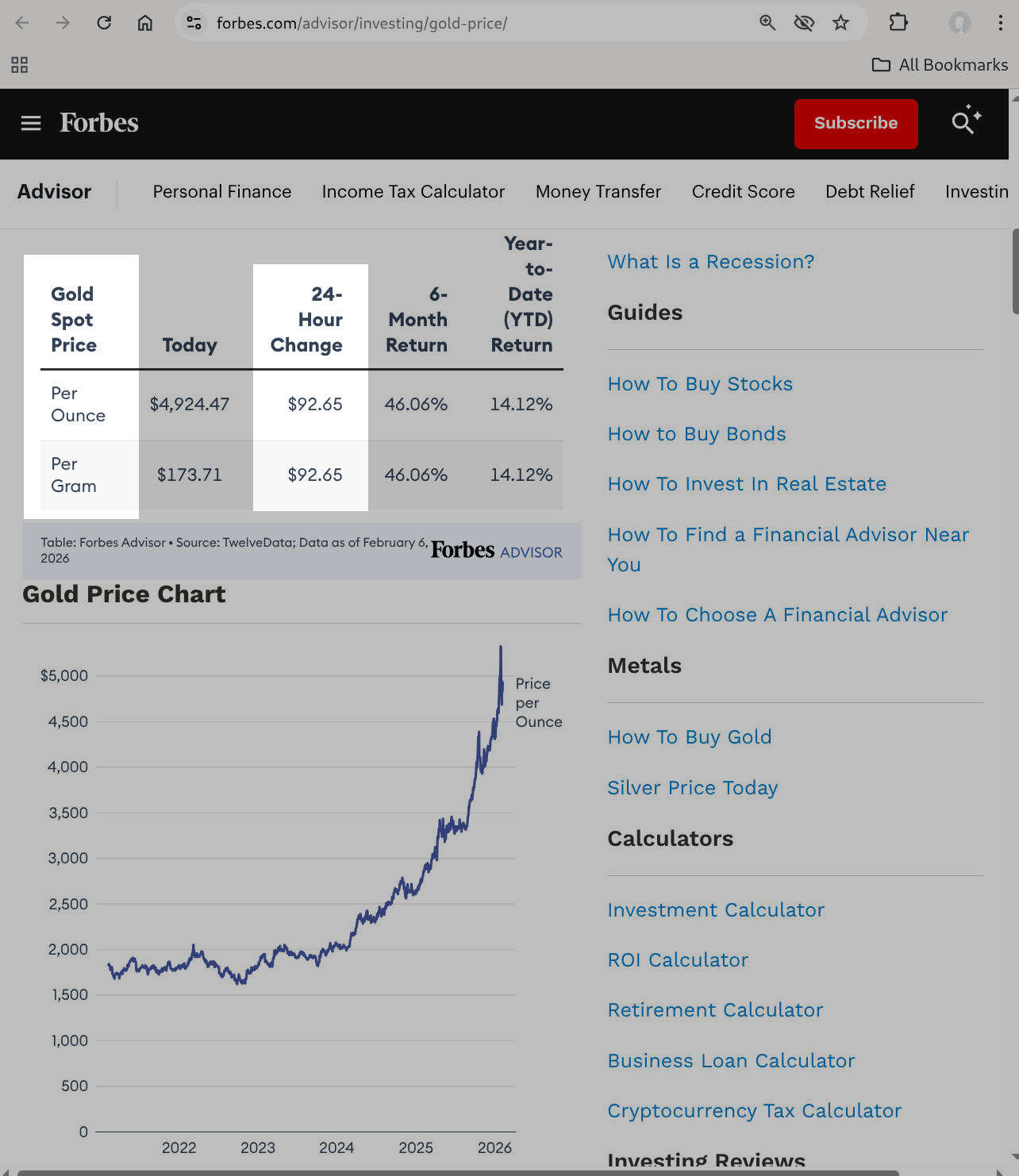

Notice the table includes two rows. The first row is the price per ounce and the second row is the price per gram. The value in the column "24-Hour Change" is repeated in both rows. In fact, the value in the second row should be approximately one thirtieth the value in the first row.

The link / URL for the page in question:

https://www.forbes.com/advisor/investing/gold-price/

An error like this comes about because the software developer made a mistake copying-and-pasting the code from the first row to the second row. On top of that, it may not have been subject to quality control. Yet artificial intelligence systems are automatically reading and processing data from news web sites like Forbes and using the data to provide investment advice on other web sites.

This is one reason why professional gold and silver investors insist on having their bullion stored in segregated accounts. Gold and silver are both an investment and also an insurance against human error and incompetence. Therefore, it would be a contradiction to buy bullion and not ensure it is in a segregated account where you can view and count it with your own eyes.

If you are looking at your balance in a spreadsheet or web site then it is possible that somebody has copy-and-pasted the same gold and silver bars into the virtual accounts of two different customers.

That thought brings us to the incredibly serious error this week at the Bithumb cryptocurrency exchange in South Korea.

Once again, it involves a staff member, most likely a developer using the wrong units. While Forbes was failing to distinguish between the correct price delta for ounces and grams, Bithumb confused the currency symbol for Bitcoin (BTC) with the currency symbol for won (KRW).

Specifically, their intention was to give each customer KRW 2,000.00 won. Instead, they gave each customer BTC 2,000 Bitcoin, a much larger sum indeed.

In fact, programmers make mistakes like this in banks and finance departments every day. However, when they attempt to post the transactions to the ledger, the central accounting system normally rejects the mistake because there is not enough money in the whole company to complete a transaction like that.

Many of these cryptocurrency exchanges have tried to re-invent the wheel and they have created their own accounting systems from scratch. Due to the presence of junior developers who lack experience, they don't even know the checks-and-balances are missing. Many of these people never worked in a real finance company before.

Many of the customers/victims have been told/deceived to believe they have a virtual wallet in the cryptocurrency exchange. In fact, in cryptocurrency, a wallet has a special meaning and the cryptographic algorithms make it impossible for the same Bitcoin to be in two real wallets at the same time. In other words, the cryptographic algorithm enforces a model similar to the segregation of gold and silver bars in safe deposit boxes.

Yet the idea of a virtual wallet is a contradiction and it is nonsense. If the exchange really had a dedicated wallet for each customer then the cryptographic algorithm would prevent the exchange from crediting a customer's wallet with Bitcoins that the exchange didn't already possess itself.

Therefore, it is not really a proper cryptocurrency exchange at all: it is more like a bank and the Bitcoin balance you see is not real digital Bitcoin in a crypto wallet. The balance you see on the screen is an IOU from the exchange promising to give you real Bitcoin at some moment in the future when you click the button to transfer or withdraw your balance to an external crypto wallet.

Trading companies that operate such a business model, where the customers are looking at synthetic balances rather than real crypto wallets, are very similar to banks. It is normally expected they will be regulated like banks. If every customer tries to withdraw their money from a normal bank on the same day, the bank will fail but the deposit guarantee scheme will replace the customer money.

If every customer on the cryptocurrency exchange tries to withdraw their money on the same day then the people who are decisive and move quickly will get paid in full and everybody else will receive nothing because their virtual wallet is not a real crypto wallet at all.

In the immediate aftermath of the error, the surplus of imaginary Bitcoins created a downward pressure on the price of Bitcoin on the exchange. Outside observers and artificial intelligence systems see the prices falling and this has a knock-on effect for the prices on other exchanges as people panic and rush to sell their Bitcoins before the price crashes into oblivion.

The error was corrected within a few hours. Nonetheless, in the medium term, people become more suspicious of crypto exchanges in general. People assume that if the IT systems at Bithumb were not subject to the same regulations as real banks then all the other exchanges in the cryptocurrency industry are perceived to be equally risky.

When people become suspicious about the exchanges, it is not long before people become suspicious about all cryptocurrency in general.

This suspicion could explain the phenomena we have seen in recent weeks, where people appear to be selling cryptocurrency to buy more traditional gold and silver bullion.

In another report from Forbes, they quote David Mercer, the chief executive of LMAX Group:

We’re witnessing in real time a collateral crunch, ...

Risk is moving faster than the collateral that supports it and this leads to episodes of volatility feeling sharper than they need to be. You can see that clearly in market behaviour; investors piled into gold at record volumes last week, while crypto has traded like a risk asset rather than the safe haven many expected.

This situation and the pattern of errors like this reveal inconvenient truths about the software engineering profession. At least some organizations have been dumbing-down for years. People who do accurate work and show attention to detail are insulted and ridiculed for being "inflexible". The latest woman chosen for an Outreachy tindernship is the keynote speaker at technical conferences. She gives people talks about how to to be dopey and submissive. If we use the words "investor" and "victim" in close proximity or if we dare to tell anybody that a virtual wallet is not a real crypto wallet then we are subject to rumours that we broke the "Code of Conduct".

Here is that diagram going around Ireland at Christmas. It shows us how many silver coins you could buy with one thousand euros at two year intervals. Clearly, the Euro and other major currencies are losing their influence:

Continue reading the inconvenient truth about cryptocurrency.

The author holds an MIT MicroMasters in Data, Economics and Development Policy. He does not hold any crypto "assets". Swiss financial regulator FINMA will neither confirm nor deny an investigation on this blog precipitated the resignation of their deputy CEO .