Bitcoin warning followed immediately by network outage

On 6 February 2026, in the early hours of Friday morning, I published a concise summary of the possible end-game facing Bitcoin investors (victims).

Mid-morning, I published a subsequent but less impactful blog commenting on the fact that even after gold mining or Bitcoin trading ceases, the service companies built around those sectors will continue to thrive and only the mum and dad investors will be left empty handed.

Early evening, there was a loss of network connectivity. Web sites including DanielPocock.com and JuristGate were inaccessible for over twelve hours.

Obviously, with Bitcoin being at an existential crossroads, there are people who have a lot to lose. Anybody daring to utter the inconvenient truth is going to be perceived as a dangerous threat to their balance sheets.

Some people borrowed money to buy more Bitcoin. Some of those people have no way to repay their loans if the price of Bitcoin does not go back up again.

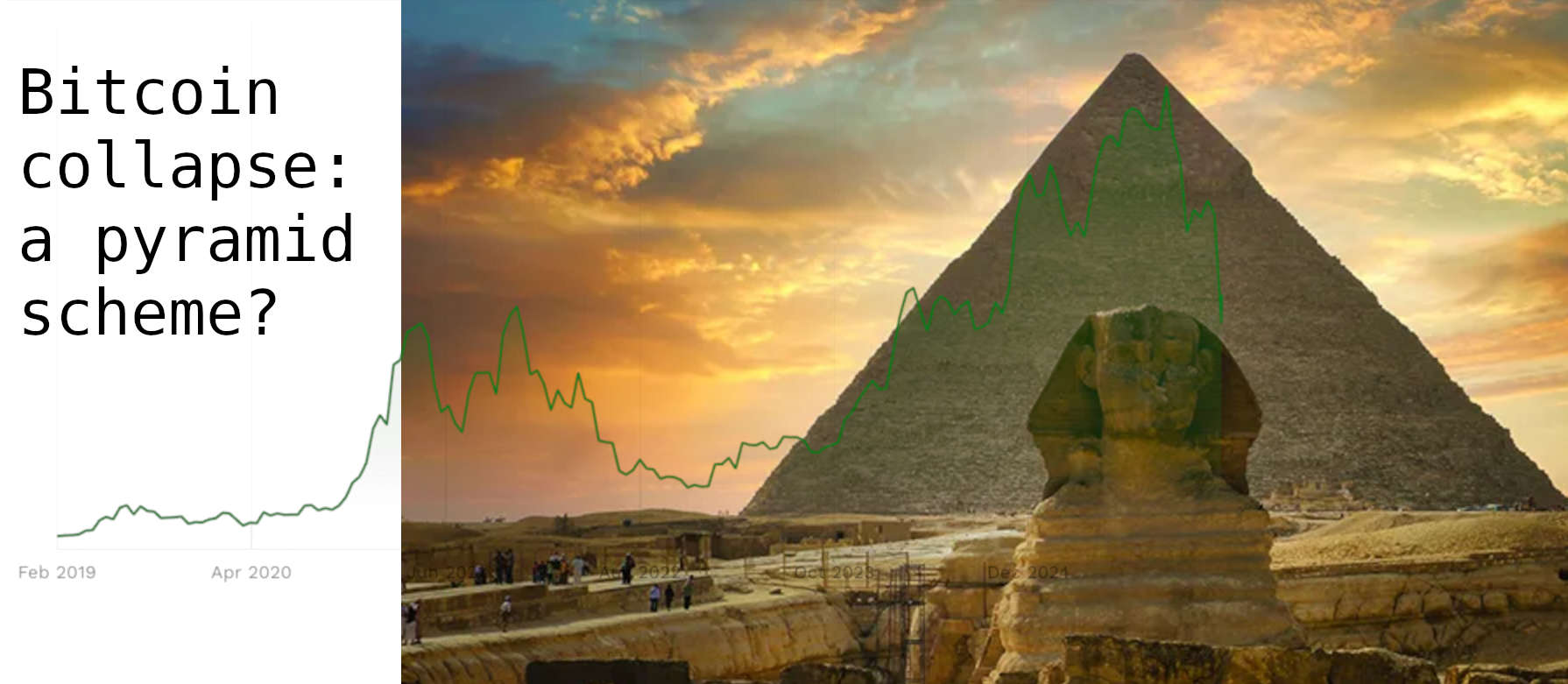

Those people become infuriated when somebody shares a picture like this, with the Bitcoin price chart superimposed over a pyramid:

Pyramid schemes are a lot like cults. If people know it is a a pyramid scheme or a cult, new victims won't join and the existing participants have no way to get their money back.

Pyramid schemes and cults both create a lot of social pressure for the founders and leaders. The leaders are addicted to their status as semi-celebrities. They walk into a room and people spontaneously begin to clap. The clapping only continues as long as people keep watching the price go up. The leaders know that if people can't get their money back, the enthusiastic crowd of supporters will turn into an angry mob.

To keep the scheme going as long as possible, they will do anything to shut down the people whispering inconvenient truths about the possibility that it is a pyramid scheme or a cult.

Nonetheless, I'm not declaring anything sinister was responsible for the outage. It is nothing more than coincidence that a lengthy outage occurred immediately after those blogs appeared. The web sites are back online for now. The outage will be reviewed and lessons learnt if necessary.

If anybody does feel the outage was more than a coincidence, feel free to copy and republish the blog post Bitcoin crash: opportunity or the end game?.

Swiss financial regulator FINMA never formally confirmed that their deputy CEO resigned because of evidence on my blog. That was just another one of those coincidences. Likewise, if Bitcoin does meet its demise in exactly the manner I described nobody should rush to conclude it was because of this blog, it is just coincidence.

Bitcoin, like religious institutions requires every participant to contribute some faith. Bitcoin also requires electricity and a network connection. Anybody who questions the faith, or cuts the Internet even with the best logic and evidence, is always ex-communicated and sometimes even burnt at the stake.

Continue reading the inconvenient truth about cryptocurrency.

The author holds an MIT MicroMasters in Data, Economics and Development Policy. He does not hold any crypto "assets". Swiss financial regulator FINMA neither confirms nor denies an investigation on this blog precipitated the resignation of their deputy CEO .